Borrowers

Personal Loans.

What you want. When you want it.

LendingUSA helps you get easy financing with low monthly payments – so you can buy more of the goods and services you want, when you want them.

The process is simple and straightforward, and we're here to help you with questions. All you do is:

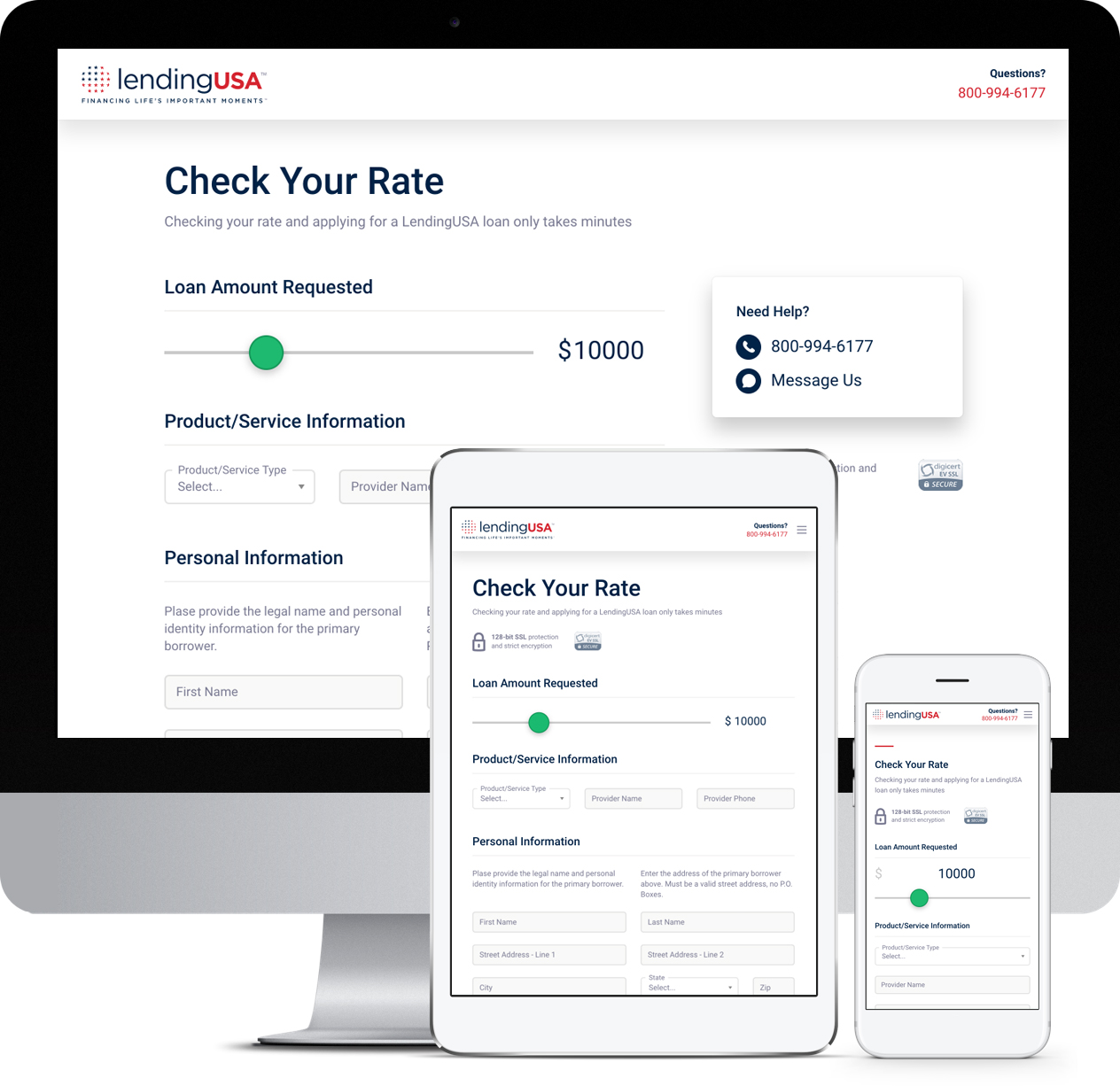

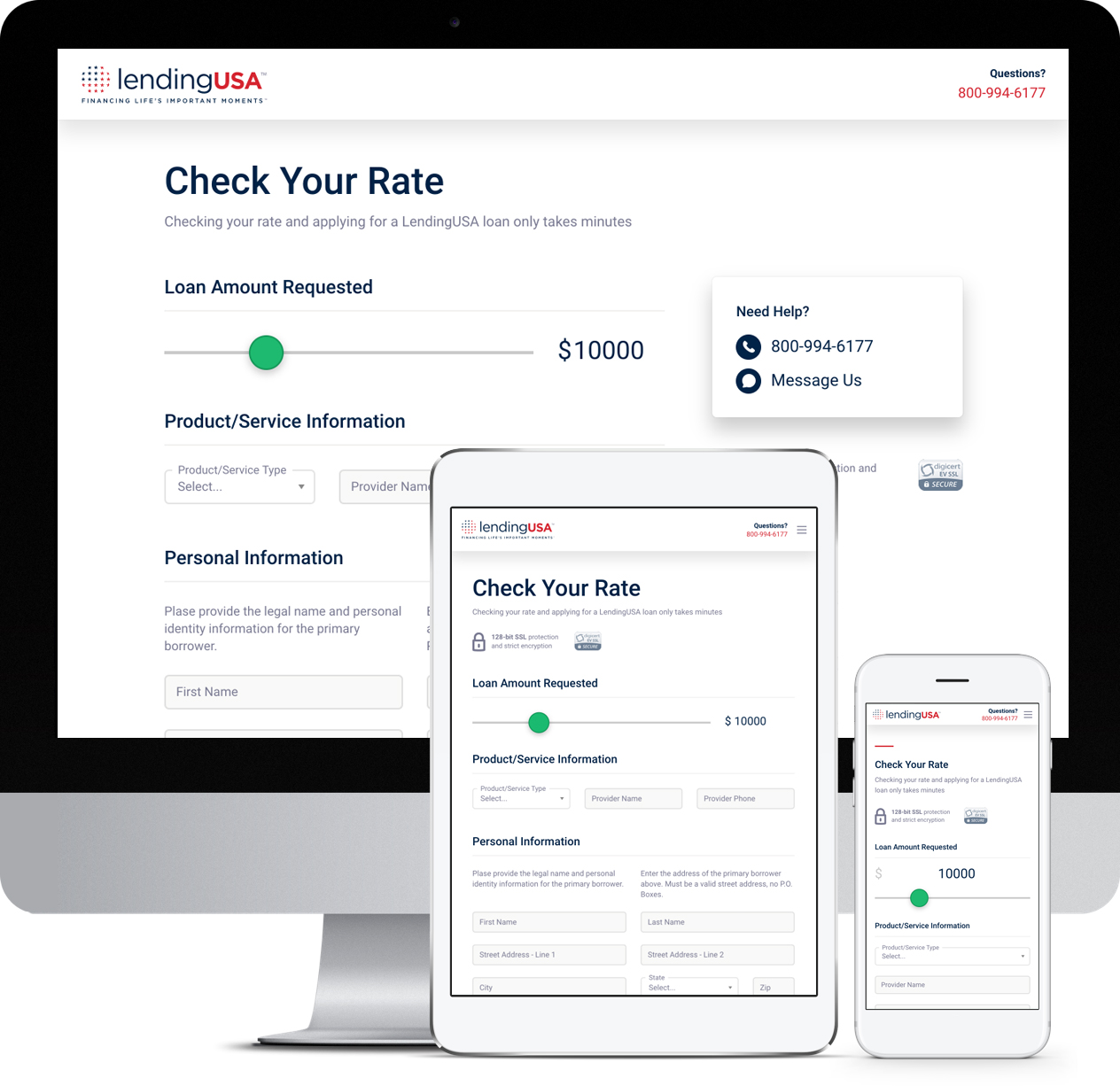

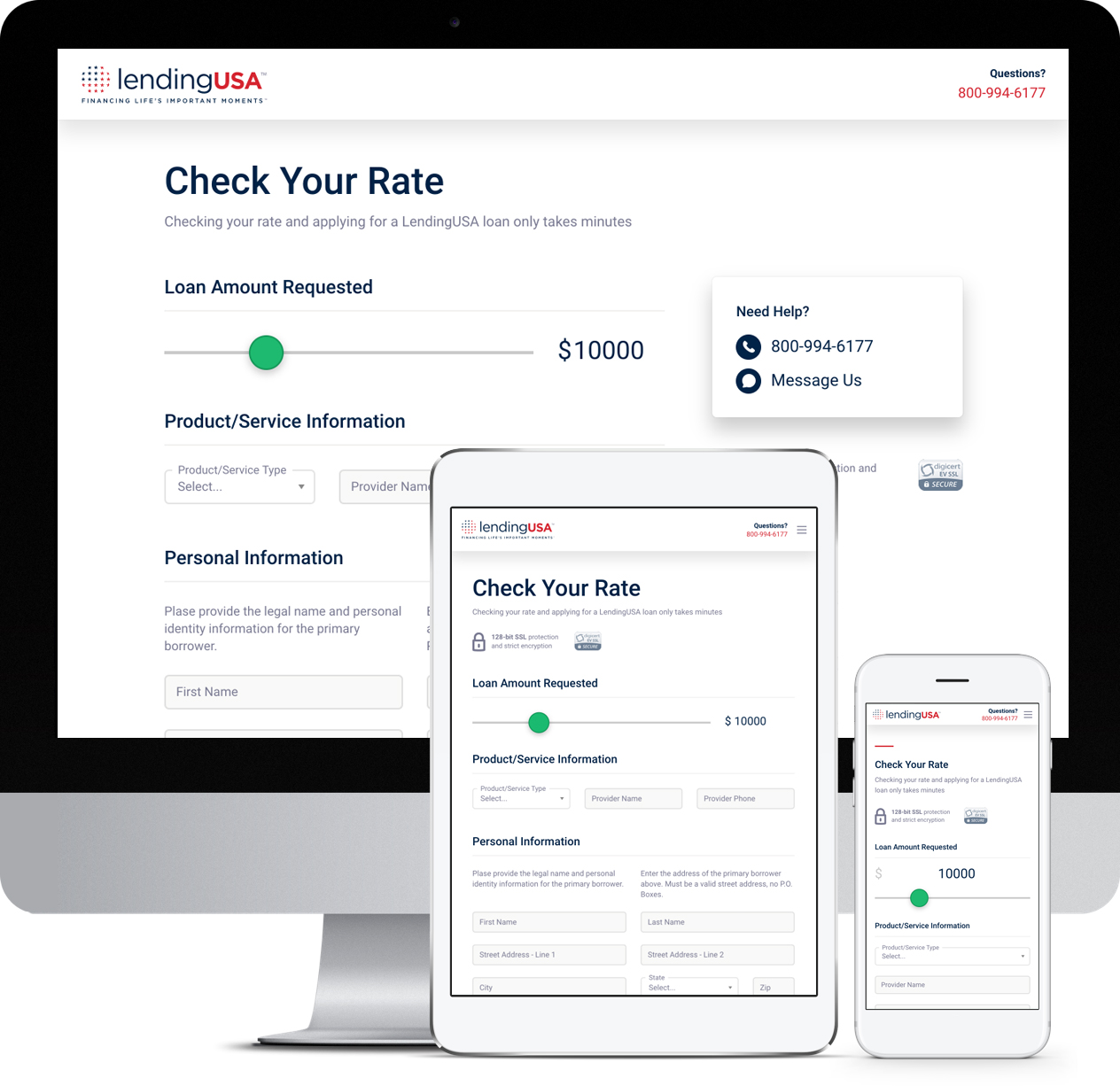

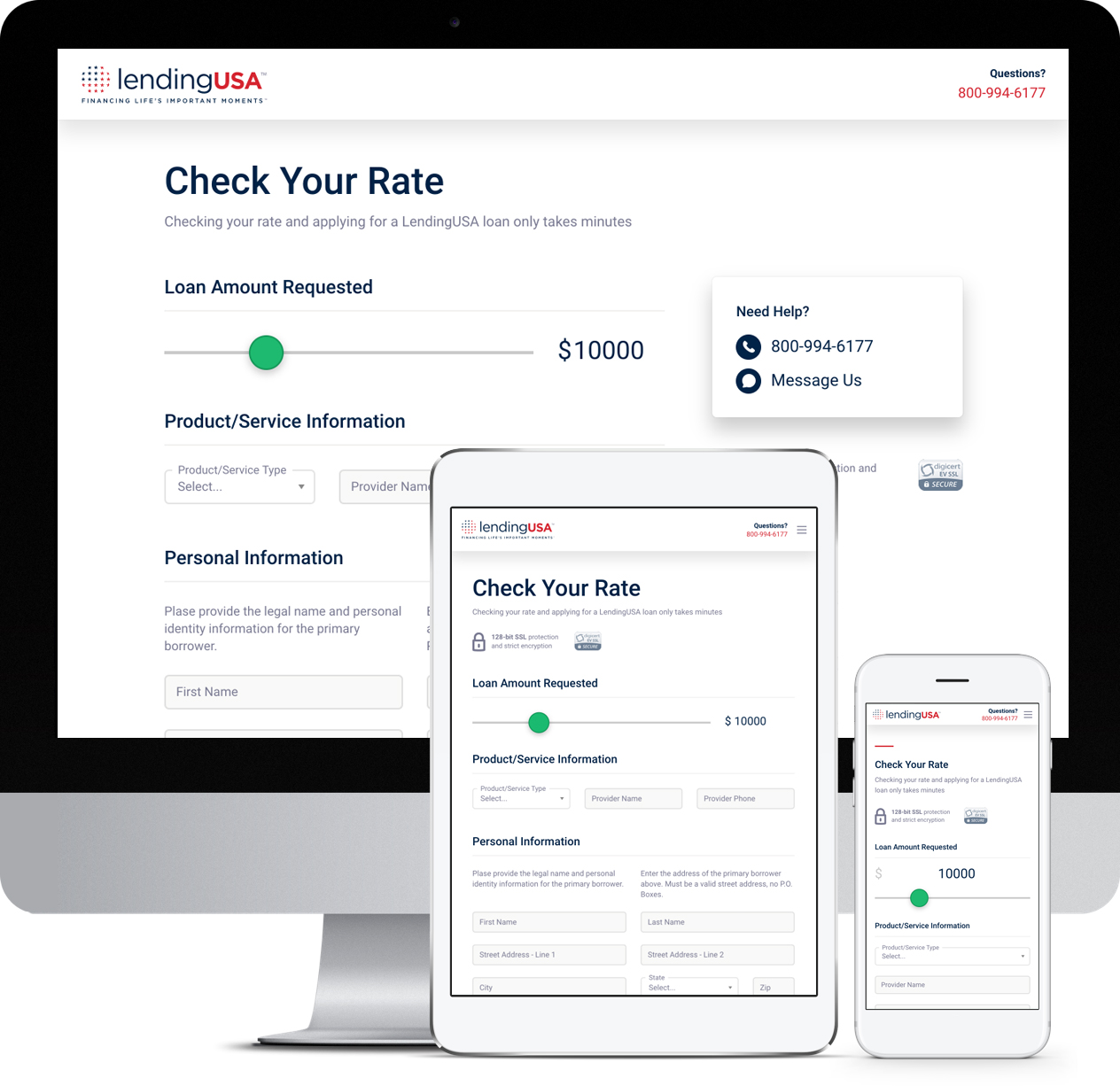

Apply online

There’s no cost to apply and no commitment required. You simply fill out the form, and one of our representatives will speak to you if required.

Get a fast pre-approval decision

There’s no waiting period or runaround. We’ve combined the best of people and technology to make some of the fastest approvals around.

Buy what you want

Once approved, you’ll be able to buy the goods and services you want. Because the important moments in your life shouldn’t have to wait.

Here’s why people choose LendingUSA

Easy Monthly Payments

We offer fixed rates and low monthly payments; no prepayment or interest rate penalties; and a no interest promotion* on select loans. That gives you the comfort to pay over time, without the worry of whether you can afford it.

More approvals

Our innovative approach to financing helps lead to more approvals across the majority of our markets. That means more ways to say "yes" to life's important moments.

Faster pre-approval decisions

We make pre-approval decisions right at your point-of-need. That creates a no-hassle experience, which turns the goods and services you want into reality. Why wait?

Greater opportunities

More than approving personal loans, we give you greater purchasing power. Power to make bigger decisions. Power to seize the moment. Power to live life on your terms. We think you’re meant to do great things. And we’re proud to help you do them.

Benefits for Borrowers

Lower Fees

We offer fixed rates and low monthly payments; no prepayment or interest rate penalties; and a no interest promotion* on select loans. That gives you the comfort to pay over time, without the worry of whether you can afford it.

More Approvals

Our innovative approach to financing helps lead to more approvals across the majority of our markets. That means more ways for you to say “yes” to life's important moments.

Faster Pre-approval Decisions

We make rapid pre-approval decisions right at your point-of-need. That creates a no-hassle experience that can turn the goods and services you want into reality.

Greater Opportunities

More than approving loans, we give you greater purchasing power. Power to make bigger decisions. Power to seize the moment. Power to live life on your terms. We think you’re meant to do great things. And we’re proud to help you do them.